UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. )

Filed by the Registrant x

Filed by a party other than the Registrant o

Check the appropriate box:

x Preliminary Proxy Statement

o Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

o Definitive Proxy Statement

o Definitive Additional Materials

o Soliciting Material pursuant to Section 240.14a-12

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

x No fee required.

o Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

o Fee paid previously with preliminary materials:

o Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

(1)

|

Amount Previously Paid:

|

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

PURE CYCLE CORPORATION

34501 East Quincy Avenue

Building 34, Box 10

Watkins, Colorado 80137

(303) 292-3456

April 2015

Dear Pure Cycle Shareholders:

Pure Cycle Corporation (“Pure Cycle”) and PCY Holdings, LLC, a wholly owned subsidiary of Pure Cycle (together with Pure Cycle, the “Company”), have signed a purchase and sale agreement with Arkansas River Farms, LLC (“Arkansas River Farms”), a newly formed affiliate of C&A Companies, Inc. and Resource Land Holdings, L.L.C., providing for the sale by the Company of approximately 14,641 acres of real property located in Bent, Otero and Prowers Counties, Colorado, 25% of the Company’s mineral rights in the property, and certain water rights, including 18,448.44 shares of stock in Fort Lyon Canal Company (collectively, the “Arkansas River Assets”), to Arkansas River Farms for approximately $53.0 million in cash, subject to such amendments thereto as the board of directors may approve.

You are being asked to vote on the proposed transaction at a special meeting of Pure Cycle shareholders to be held on May 15, 2015, at 10:00 a.m. Mountain Time at the offices of Davis Graham & Stubbs LLP, 1550 Seventeenth Street, Suite 500, Denver, Colorado 80202. This letter and the attached notice of special meeting and proxy statement describes the proposed sale in greater detail. You are urged to read these documents carefully and in their entirety.

The board of directors of Pure Cycle has determined that the proposed transaction is in the best interest of the Company and its shareholders and unanimously recommends that you vote “FOR” the sale of the Arkansas River Assets.

Your vote is important. If a shareholder fails to vote its shares of common stock, it will have the same effect as a vote against this proposal.

Therefore, whether you own relatively few or a large number of shares of our stock, it is important that your shares be represented and voted at the special meeting. If you are not attending the special meeting in person, you are urged to vote via the Internet, by telephone, or by signing, dating and returning the enclosed proxy card in the enclosed postage-paid envelope. Your cooperation is appreciated since a majority of the votes entitled to be cast must be represented, either in person or by proxy, to constitute a quorum for the transaction of business at the special meeting and approve the proposal.

On behalf of the board of directors and management, we thank you for your continued support.

Sincerely,

PURE CYCLE CORPORATION

/s/ Mark W. Harding

Mark W. Harding, President

PURE CYCLE CORPORATION

34501 East Quincy Avenue

Building 34, Box 10

Watkins, Colorado 80137

(303) 292-3456

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

To be held on May 15, 2015

TO THE SHAREHOLDERS OF PURE CYCLE CORPORATION:

We will hold a special meeting of the shareholders of Pure Cycle Corporation, a Colorado corporation (“Pure Cycle”). The meeting will be held on May 15, 2015 at 10:00 a.m. Mountain Time at the offices of Davis Graham & Stubbs LLP, 1550 Seventeenth Street, Suite 500, Denver, Colorado 80202. The purposes of the meeting are to:

|

|

1.

|

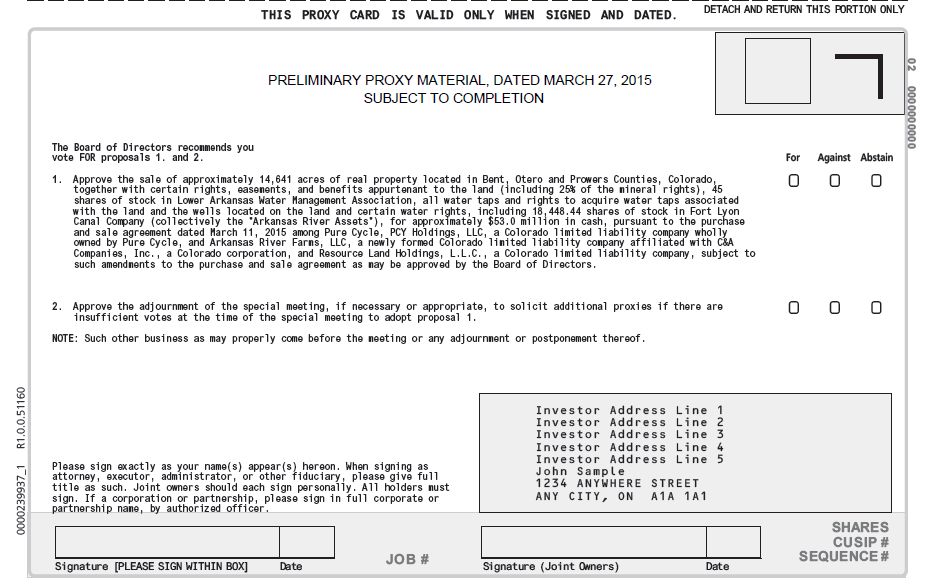

Approve the sale of approximately 14,641 acres of real property located in Bent, Otero and Prowers Counties, Colorado, together with certain rights, easements, and benefits appurtenant to the land (including 25% of the mineral rights), 45 shares of stock in Lower Arkansas Water Management Association, all water taps and rights to acquire water taps associated with the land and the wells located on the land and certain water rights, including 18,448.44 shares of stock in Fort Lyon Canal Company (collectively the “Arkansas River Assets”), for approximately $53.0 million in cash, pursuant to the purchase and sale agreement dated March 11, 2015, among Pure Cycle, PCY Holdings, LLC, a Colorado limited liability company wholly owned by Pure Cycle, and Arkansas River Farms, LLC, a newly formed Colorado limited liability company affiliated with C&A Companies, Inc., a Colorado corporation, and Resource Land Holdings, L.L.C., a Colorado limited liability company, subject to such amendments to the purchase and sale agreement as may be approved by the board of directors.

|

|

|

2.

|

Approve the adjournment of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes at the time of the special meeting to adopt proposal 1.

|

|

|

3.

|

Transact such other business as may properly come before the special meeting or any adjournments or postponements of the special meeting.

|

Only shareholders of record of as of 5:00 p.m. Mountain Time on March 13, 2015, the record date for the special meeting, will be entitled to notice of and to vote at the special meeting or any adjournments or postponements of the special meeting.

Pure Cycle’s board of directors unanimously recommends that you vote “FOR” each of proposal 1 and proposal 2.

Your vote is very important. Whether or not you expect to attend the special meeting in person, we urge you to submit a proxy as promptly as possible by (1) accessing the Internet website specified on your proxy card, (2) calling the toll-free number specified on your proxy card or (3) marking, signing, dating and returning the enclosed proxy card in the postage-paid envelope provided, so that your shares may be represented and voted at the special meeting. If your shares are held in the name of a nominee or intermediary, please follow the instructions on the voting instruction card furnished by the record holder.

| |

BY ORDER OF THE BOARD OF DIRECTORS

|

| |

|

| |

/s/ Scott E. Lehman

|

| |

Scott E. Lehman, Secretary

|

TABLE OF CONTENTS

| CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS |

1 |

| |

|

| ABOUT THE SPECIAL MEETING |

1 |

| |

|

| SUMMARY |

2 |

| |

|

| QUESTIONS AND ANSWERS ABOUT VOTING PROCEDURES AND THE SPECIAL MEETING |

4 |

| |

|

| VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF |

7 |

| |

Summary |

7 |

| |

Voting Agreements |

8 |

| |

|

|

| PROPOSAL 1 APPROVAL OF THE SALE OF THE ARKANSAS RIVER ASSETS PURSUANT TO THE PURCHASE AND SALE AGREEMENT |

9 |

| |

Information About the Arkansas River Assets |

9 |

| |

Sale of the Arkansas River Assets |

10 |

| |

The Purchase and Sale Agreement |

13 |

| |

|

|

| PROPOSAL 2 APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING, IF NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES |

18 |

| |

|

| ACTION TO BE TAKEN UNDER THE PROXY |

18 |

| |

|

| OTHER INFORMATION |

19 |

| |

Future Shareholder Proposals |

19 |

| |

Delivery of Materials to Shareholders with Shared Addresses |

19 |

| |

Where You Can Find Additional Information |

19 |

| |

|

|

| ANNEX A: Purchase and Sale Agreement |

|

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS

This proxy statement contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements are all statements, other than statements of historical facts, included in this proxy statement that address activities, events or developments that we expect or anticipate will or may occur in the future, such as statements about the timing and consummation of the sale of the Arkansas River Assets, plans to terminate the purchase and sale agreement if shareholder approval is not obtained, strategies for Pure Cycle after the sale of the Arkansas River Assets, and water project investment opportunities. The words “anticipate,” “likely,” “may,” “should,” “could,” “will,” “believe,” “estimate,” “expect,” “plan,” “intend” and similar expressions are intended to identify forward-looking statements. Investors are cautioned that forward-looking statements are inherently uncertain and involve risks and uncertainties that could cause actual results to differ materially. Factors that could cause actual results to differ from projected results include, without limitation: the possibility that we may be unable to obtain shareholder approval or the parties to the Purchase and Sale Agreement may be unable to satisfy the other conditions to closing the proposed transaction; the proposed transaction may involve unexpected costs; the risk factors discussed in Part I, Item 1A of our most recent Annual Report on Form 10-K; and those factors discussed from time to time in our press releases, public statement and documents filed or furnished with the U.S. Securities and Exchange Commission. Except as required by law, we disclaim any obligation to update publicly any forward-looking statements, whether as a result of new information, future events or otherwise.

PURE CYCLE CORPORATION

34501 East Quincy Avenue

Building 34, Box 10

Watkins, Colorado 80137

(303) 292-3456

PROXY STATEMENT FOR THE

SPECIAL MEETING OF SHAREHOLDERS

To be held on May 15, 2015

ABOUT THE SPECIAL MEETING

This proxy statement is being made available to shareholders in connection with the solicitation of proxies by the board of directors of Pure Cycle Corporation (“Pure Cycle”) for use at the special meeting of shareholders of Pure Cycle to be held at the offices of Davis Graham & Stubbs LLP, 1550 Seventeenth Street, Suite 500, Denver, Colorado 80202, on May 15, 2015, at 10:00 a.m. Mountain Time or at any adjournment or postponement thereof. This proxy statement will be made available to shareholders on or about April [ ] 2015. The cost of soliciting proxies is being paid by Pure Cycle. Pure Cycle’s officers, directors, and other regular employees may, without additional compensation, solicit proxies personally or by other appropriate means.

Pure Cycle and PCY Holdings, LLC, a wholly owned subsidiary of Pure Cycle (together with Pure Cycle, the “Company”), have signed a purchase and sale agreement with Arkansas River Farms, LLC (“Arkansas River Farms”), a newly formed affiliate of C&A Companies, Inc. and Resource Land Holdings, L.L.C., providing for the sale by the Company of approximately 14,641 acres of real property located in Bent, Otero and Prowers Counties, Colorado, together with certain rights, easements, and benefits appurtenant to the land, including all improvements, all sand and gravel, 25% of the Company’s mineral rights, and certain water rights, including 18,448.44 shares of stock in Fort Lyon Canal Company, 45 shares of stock in Lower Arkansas Water Management Association, all water taps and rights to acquire water taps associated with the land and the wells located on the land (collectively, the “Arkansas River Assets”), to Arkansas River Farms for approximately $53.0 million in cash, subject to such amendments to the purchase and sale agreement as may be approved by the board of directors.

The Arkansas River Assets generated $1,068,000 and $1,241,900 or approximately 35% and 67% of Pure Cycle’s total revenues for the fiscal years ended August 31, 2014 and 2013, respectively. The sale represents 49% of Pure Cycle’s market value, based on a closing share price of $4.46 on March 11, 2015. The assets being sold have a book value of approximately $69 million, or 64% of Pure Cycle’s total assets as of November 30, 2014. Because of the significance of the proposed transaction, Pure Cycle’s board of directors determined to seek shareholder approval of the transaction, and the purchase and sale agreement requires Pure Cycle to hold a special meeting to consider the agreement and the proposed transaction no later than 75 days after the date of the agreement. If Pure Cycle does not obtain shareholder approval, it may terminate the purchase and sale agreement, subject to paying a termination fee of $1,000,000.

As used in this proxy statement, the terms “Company,” “we,” “our,” and “us” refer to Pure Cycle and its subsidiaries.

SUMMARY

The following is a summary that highlights information contained in this proxy statement. This summary may not contain all of the information that may be important to you. For a more complete description of the purchase and sale agreement and the sale of the Arkansas River Assets, we encourage you to read carefully this entire proxy statement, including the attached annex.

|

The Parties to the Purchase and Sale Agreement

|

Pure Cycle Corporation, a Colorado corporation;

PCY Holdings LLC, a Colorado limited liability company wholly owned by Pure Cycle; and

Arkansas River Farms, LLC, a newly formed Colorado limited liability company affiliated with C&A Companies, Inc., a Colorado corporation, and Resource Land Holdings, L.L.C., a Colorado limited liability company.

|

| |

|

|

Principal Executive Office

|

34501 East Quincy Avenue

Building 34, Box 10

Watkins, Colorado 80137

(303) 292-3456

|

| |

|

|

Description of Arkansas River Assets

|

Our Arkansas River Assets consist of approximately 14,641 acres of real property located in Bent, Otero and Prowers Counties, Colorado, together with certain rights, easements, and benefits appurtenant to the land, including all improvements, all sand and gravel, 25% of our mineral rights, and certain water rights, including 18,448.44 shares of stock in Fort Lyon Canal Company, 45 shares of stock in Lower Arkansas Water Management Association, all water taps and rights to acquire water taps associated with the land and the wells located on the land.

|

| |

|

|

Reasons for the Sale of the Arkansas River

Assets

|

The sale price of the Arkansas River Assets represents an attractive value for the Company and its shareholders, and the net sale proceeds will enable us to pay off all of our debt (approximately $6 million), fund our $6 million in commitments to the Water Infrastructure Supply Efficiency (“WISE”) project over the next six years and provide us with funds for working capital and general corporate purposes. The board of directors will consider additional investments in water, wastewater, infrastructure, and its Sky Ranch project.

|

| |

|

|

Proposal to be Considered at the Special Meeting

|

To approve the sale of the Arkansas River Assets pursuant to the purchase and sale agreement to Arkansas River Farms for approximately $53.0 million in cash, subject to such amendments to the purchase and sale agreement as the board of directors may approve.

|

| |

|

|

Recommendation of the Board

|

FOR the proposal regarding the sale of the Arkansas River Assets to be considered at the special meeting.

|

| |

|

|

Regulatory Approvals

|

None.

|

| |

|

|

Dissenters’ or Appraisal Rights

|

None.

|

| |

|

|

Conditions to Completion of the Sale of the Arkansas River Assets

|

Completion of the due diligence of the Arkansas River Assets to the satisfaction of Arkansas River Farms;

|

| |

|

| |

Shareholder approval of purchase and sale agreement;

|

| |

|

| |

Delivery by Arkansas River Farms of (i) the balance of the purchase price, as adjusted pursuant to the purchase and sale agreement and credited for the $1 million earnest money deposit; and (ii) such other documents as may be reasonably be required to complete the transactions contemplated by the purchase and sale agreement;

|

| |

|

| |

all representations and warranties of the Company being true and correct as of the closing;

|

| |

|

| |

Delivery by the Company of documents typical of a transaction of this nature including (i) deeds with respect to the real property and certain water rights; (ii) original certificates representing certain water rights; and (iii) an assignment of all leases; and

|

| |

|

| |

Upon written request from Arkansas River Farms, the termination by the Company of any leases that are terminable by it without penalty as landlord under such leases.

|

| |

|

|

Rights to terminate the Purchase and Sale Agreement

|

By the Company:

|

| |

|

| |

· if Arkansas River Farms fails to perform any of its material obligations under the purchase and sale agreement and fails to cure within five business days of notice of such default;

|

| |

|

| |

· if we do not obtain shareholder approval of the purchase and sale agreement, in which case we will be required to pay Arkansas River Farms a termination fee of $1 million; or

|

| |

|

| |

· if the board of directors receives a superior proposal to acquire the Arkansas River Assets and determines to accept the proposal; however, Arkansas River Farms will have the right to negotiate with the Company for a five business day period following notice from the Company to Arkansas River Farms of such superior proposal prior to the Company’s acceptance of such superior proposal. If the board of directors terminates the purchase and sale agreement pursuant to a superior proposal, the earnest money deposit shall be returned, and we shall pay a termination fee of $2.5 million to Arkansas River Farms.

|

| |

|

| |

|

| |

By Arkansas River Farms:

|

| |

|

| |

· if we fail to respond to objections by Arkansas River Farms to the commitment for an owner’s extended policy of title insurance and the survey within five business days of such objections;

|

| |

|

| |

· if it is not satisfied with the Arkansas River Assets following the due diligence period;

|

| |

|

| |

· if we fail to perform any of our material obligations under the purchase and sale agreement and fails to cure within five business days of notice of such default;

|

| |

|

| |

· if any portion of the Arkansas River Assets is condemned, access to the properties is taken or proceedings or negotiations therefor are commenced prior to closing; or

|

|

|

|

| |

· if any material damage (i.e., in excess of 2% of the purchase price) occurs to the Arkansas River Assets between signing and closing.

|

| |

|

|

Voting Agreements

|

Arkansas River Farms has entered into separate voting agreements with the holders of 6,818,494 shares, or 28.37%, of the outstanding common stock of Pure Cycle, pursuant to which certain directors and a significant shareholder have agreed to vote in favor of the sale of the Arkansas River Assets.

|

| |

|

|

Interests of Executive Officers and Directors

of Pure Cycle in the Sale of

the Arkansas River Assets

|

None

|

QUESTIONS AND ANSWERS ABOUT VOTING PROCEDURES

AND THE SPECIAL MEETING

What is the purpose of the special meeting?

At the special meeting, shareholders are asked to act upon the matters outlined above in the Notice of Special Meeting of Shareholders and as described in this proxy statement. The matters to be considered are (i) the approval of the sale of our Arkansas River Assets pursuant to the purchase and sale agreement for $53.0 million in cash, subject to such amendments to the purchase and sale agreement as may be approved by the board of directors, (ii) the approval of the adjournment of the special meeting, if necessary or appropriate, to solicit additional proxies if there are insufficient votes to adopt proposal 1 and (iii) such other matters as may properly come before the special meeting. Management will be available to respond to appropriate questions.

What are the principal conditions of the proposed sale of the Arkansas River Properties?

Arkansas River Farms’ obligation to purchase the Arkansas River Assets is subject to its right to complete to its satisfaction a title review and other due diligence of the Arkansas River Assets. If Arkansas River Farms is not satisfied with the Arkansas River Assets, in its sole discretion, it may terminate the purchase and sale agreement at any time prior to the end of the due diligence period. Additionally, if shareholder approval of the sale is not obtained, the purchase and sale agreement may be terminated by the Company, and the Company would be required to pay a $1 million termination fee. For a description of the other terms and conditions of the purchase and sale agreement, please see Proposal 1 – The Purchase and Sale Agreement beginning on page 13 of this proxy statement. A copy of the purchase and sale agreement is attached to this proxy statement as Annex A.

Who is entitled to vote and how many votes do I have?

If you were a shareholder of record as of 5:00 p.m. Mountain Time on March 13, 2015, the record date for the special meeting, you will be entitled to vote at the special meeting or any adjournments or postponements thereof. On the record date, there were 24,037,598 shares of Pure Cycle’s 1/3 of $0.01 par value common stock (“common stock”) issued and outstanding. Each outstanding share of Pure Cycle common stock will be entitled to one vote on each matter acted upon. There is no cumulative voting.

How do I vote?

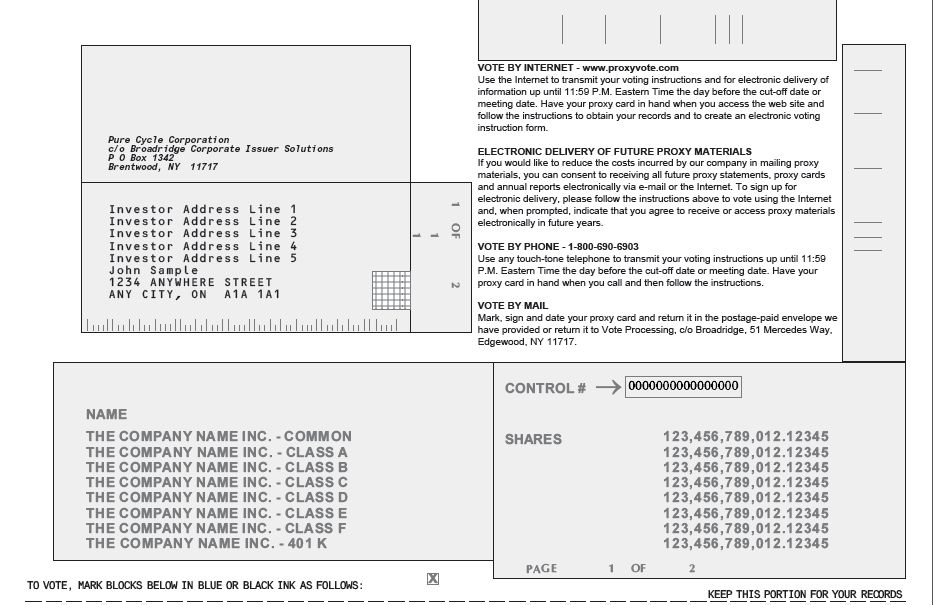

If your shares are held in an account at a bank, brokerage firm, or other nominee in “street name,” you need to submit voting instructions to your bank, brokerage firm, or other nominee in order to cast your vote. If you wish to vote in person at the special meeting, you must obtain a valid proxy from the nominee that holds your shares. If you are the shareholder of record, you may vote your shares by completing, signing and dating the enclosed proxy card and then mailing it to our transfer agent, Broadridge Corporate Issuer Solutions, in the pre-addressed envelope provided. You may also vote your shares by phone or online by following the instructions on the proxy card or by attending the special meeting in person.

Can I change or revoke my vote?

A proxy may be revoked by a shareholder any time before it is voted at the special meeting by submission of another proxy bearing a later date, by attending the special meeting and voting in person, or if you are a shareholder of record, by written notice of revocation to the Secretary of Pure Cycle delivered before the date of the special meeting.

Is my vote confidential?

Proxy instructions, ballots and voting tabulations that identify individual shareholders are handled in a manner that protects your voting privacy. Your vote will not be disclosed within Pure Cycle or to third parties, except: (1) as necessary to meet applicable legal requirements, (2) to allow for the tabulation of votes and certification of the vote, and (3) to facilitate a successful proxy solicitation. Occasionally, shareholders provide written comments on their proxy cards, which are forwarded to management of Pure Cycle.

Will my shares held in street name be voted if I do not provide my proxy?

If you hold your shares through a bank, broker, or other nominee, your shares must be voted by the nominee. If you do not provide voting instructions, under the rules of the securities exchanges, the nominee’s discretionary authority to vote your shares is limited to “routine” matters. Proposals 1 and 2 are not considered routine matters for this purpose, so if you do not provide your proxy, your shares will not be voted at the special meeting with respect to these proposals. In this case your shares will be treated as “broker non-votes.”

A “broker non-vote” occurs when a nominee holding shares for a beneficial owner does not vote on a particular proposal because the nominee does not have discretionary voting power with respect to that item and has not received voting instructions from the beneficial owner.

What is a quorum?

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of common stock entitled to vote constitutes a quorum at the special meeting. Abstentions are counted for the purposes of determining whether a quorum is present at the special meeting. Broker non-votes will not count as present unless the nominee has been given power to vote on at least one of the proposals presented at the meeting. Shares of the common stock held by the shareholders who are not present in person or by proxy will not be counted towards a quorum.

How many votes are required to approve the proposal?

|

|

·

|

Sale of Arkansas River Assets – Approval of proposal 1 requires the affirmative vote of the majority of the shares of common stock issued and outstanding and entitled to vote at the special meeting. With respect to proposal 1, you may vote “FOR,” “AGAINST,” or you may “ABSTAIN.” If you hold your shares through a nominee such as a broker or bank (i.e., in street name), you must provide your broker with instructions on how to vote the street name shares. Under the rules of The NASDAQ Stock Market LLC (the “NASDAQ”), if your broker holds your shares in its name, your broker may not vote your shares on the proposal regarding sale of the Arkansas River Assets absent instruction from you. Consequently, without your voting instruction on this proposal, a broker non-vote will occur. An abstention, a failure to vote, and a failure to instruct your broker how to vote shares held for you in your broker’s name will each have the same effect as a vote “AGAINST” the proposal regarding sale of the Arkansas River Assets.

|

|

|

·

|

Adjournment of the special meeting to solicit additional proxies and other matters – The number of votes cast in favor of the proposal at the special meeting must exceed the number of votes cast against the proposal for the approval of proposal 2 and other matters. For proposal 2 and any other business matters to be voted on, you may vote “FOR,” “AGAINST,” or you may “ABSTAIN.” Abstentions and broker non-votes will not be counted as votes for or against a proposal and, therefore, have no effect on the vote.

|

If no specification is made, then the shares will be voted “FOR” proposal 1 regarding sale of the Arkansas River Assets, “FOR” proposal 2, and otherwise, in accordance with the recommendation of the board of directors.

Can the purchase and sale agreement be amended?

Even if the purchase and sale agreement is approved by the shareholders, the board of directors may approve entering into amendments to the purchase and sale agreement if it concludes that to do so would be in the best interest of the Company and the shareholders. Arkansas River Farms has the ability to terminate the agreement if it is not satisfied in its sole discretion with the results of its due diligence on the Arkansas River Assets. Under such circumstances, solely as an example, the board could determine that authorizing an amendment to the purchase and sale agreement to remove certain assets found unsatisfactory by the buyer or to adjust the purchase price would be preferable for the Company and its shareholders rather than having Arkansas River Farms exercise its termination rights.

Does Pure Cycle expect there to be any additional matters presented at the special meeting?

Other than the items of business described in this proxy statement, Pure Cycle is not aware of any other business to be acted upon at the special meeting. If you grant a proxy, the persons named as proxy holders, Mark W. Harding and Harrison H. Augur, have the discretion to vote your shares on any additional matter properly presented for a vote at the special meeting.

When will the results of the voting being announced?

Pure Cycle will announce preliminary results at the special meeting and will publish final results in a current report on Form 8-K to be filed within four business days of the date of the special meeting.

What will happen if shareholders do not approve the proposal regarding the sale of the Arkansas River Assets?

If the proposal is not approved by the shareholders, we may terminate the purchase and sale agreement; however, we will be required pay a termination fee of $1 million if shareholder approval is not obtained. The board of directors currently expects to terminate the purchase and sale agreement if shareholder approval is not obtained.

How will Pure Cycle’s board members and significant shareholder vote the shares owned by them?

Pursuant to the purchase and sale agreement, certain shareholders who are directors of Pure Cycle and shareholders over whose shares the directors have voting control (collectively owning approximately 6,818,494 shares, or 28.37%, of common stock as of the record date of the special meeting) have entered into voting agreements whereby they have agreed to vote in favor of the sale of the Arkansas River Assets pursuant to the purchase and sale agreement at the special meeting, unless the purchase and sale agreement is terminated in accordance with its terms prior to the date of the meeting.

Who can help answer my questions?

If you have any questions about how to submit your proxy, or if you need additional copies of this proxy statement or the enclosed proxy card, or if you have any questions about the proposal regarding the sale of the Arkansas River Assets, you should contact the following:

Mark Harding

President

Pure Cycle Corporation

34501 East Quincy Avenue

Building 34, Box 10

Watkins, Colorado 80137

Telephone: (303) 292-3456

VOTING SECURITIES AND PRINCIPAL HOLDERS THEREOF

Summary

The following table sets forth information as of March 13, 2015, as to the beneficial ownership of shares of Pure Cycle common stock by (i) each person (or group of affiliated persons) known to Pure Cycle to own beneficially 5% or more of the common stock, (ii) each director of Pure Cycle, (iii) each executive officer and (iv) all directors and executive officers as a group. All information is based on information filed by such persons with the Securities and Exchange Commission (the “SEC”) and other information provided by such persons to Pure Cycle. Except as otherwise indicated, Pure Cycle believes that each of the beneficial owners listed has sole investment and voting power with respect to such shares. On March 13, 2015, there were 24,037,598 shares outstanding of Pure Cycle common stock. Shares not outstanding but deemed beneficially owned by virtue of the right of a person to acquire shares within 60 days of March 13, 2015, are included as outstanding and beneficially owned for that person, but are not treated as outstanding for the purpose of computing the percentage ownership of any other person.

Name and address of beneficial owner

|

|

Amount and nature of beneficial ownership

|

|

|

|

|

|

Mark W. Harding **

|

|

|

760,576 |

1 |

|

|

3.16 |

% |

|

Harrison H. Augur **

|

|

|

141,281 |

2 |

|

|

* |

|

|

Arthur G. Epker III - One International Place, Suite 2401, Boston, MA 02110

|

|

|

30,500 |

3 |

|

|

* |

|

|

Richard L. Guido **

|

|

|

33,000 |

4 |

|

|

* |

|

|

Peter C. Howell **

|

|

|

36,000 |

5 |

|

|

* |

|

|

All officers and directors as a group (5 persons)

|

|

|

1,001,357 |

6 |

|

|

4.19 |

% |

|

PAR Capital Management, Inc. / PAR Investment Partners, L.P. / PAR Group, L.P.

One International Place, Suite 2401, Boston, MA 02110

|

|

|

5,982,970 |

7 |

|

|

24.89 |

% |

|

Trigran Investments, Inc.

630 Dundee Road, Suite 230, Northbrook, IL 60062

|

|

|

2,324,485 |

8 |

|

|

9.67 |

% |

_________________________

* Less than 1%

** Address is Pure Cycle’s address: 34501 East Quincy Avenue, Building 34, Box 10, Watkins, Colorado 80137

|

1.

|

Includes 33,333 shares purchasable by Mr. Harding under options exercisable within 60 days. Includes 210,000 shares of common stock held by SMA Investments, LLLP, a limited liability limited partnership controlled by Mr. Harding.

|

|

2.

|

Includes 33,000 shares purchasable by Mr. Augur under options exercisable within 60 days. Includes 10,000 shares of common stock held by Patience Partners, LLC, a limited liability company in which a foundation controlled by Mr. Augur is a 60% member and Mr. Augur is a 20% managing member. Includes 46,111 shares of common stock held in a margin account owned by Auginco, a Colorado partnership, which is owned 50% by Mr. Augur and 50% by his wife.

|

|

3.

|

Includes 30,500 shares purchasable by Mr. Epker under options exercisable within 60 days. Excludes all shares of common stock held directly by PAR Investment Partners, L.P. (PIP). PAR Capital Management, Inc. (PCM), as the general partner of PAR Group, L.P. (PGL), which is the general partner of PIP, has investment discretion and voting control over shares held by PIP. No shareholder, director, officer or employee of PCM has beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act) of any shares held by PIP. Mr. Epker is an officer of PCM and has been a director of Pure Cycle since 2007. In his capacity as an officer of PCM, Mr. Epker has sole voting and dispositive power with respect to the shares of common stock held by PIP; however, Mr. Epker disclaims beneficial ownership of the shares held by PIP.

|

|

4.

|

Includes 33,000 shares purchasable by Mr. Guido under options exercisable within 60 days.

|

|

5.

|

Includes 35,500 shares purchasable by Mr. Howell under options exercisable within 60 days.

|

|

6.

|

Includes the following shares:

|

|

|

a.

|

210,000 shares held by SMA Investments, LLLP as described in footnote 1 above,

|

|

|

b.

|

165,333 shares purchasable by directors and officers under options exercisable within 60 days, and

|

|

|

c.

|

10,000 shares of common stock held by Patience Partners, LLC, and 46,111 shares of common stock held by Auginco, as described in footnote 2 above.

|

|

7.

|

PIP owns directly 5,982,970 shares. PGL, through its control of PIP as general partner, has sole voting and dispositive power with respect to all 5,982,970 shares owned beneficially by PIP. PCM, through its control of PGL as general partner, has sole voting and dispositive power with respect to all 5,982,970 shares owned beneficially by PIP. Excludes 30,500 shares purchasable by Mr. Epker under options exercisable within 60 days. PIP, PGL and PCM disclaim beneficial ownership of such option shares.

|

|

8.

|

This disclosure is based on a Schedule 13G/A filed by Trigran Investments, Inc. (“TII”), Douglas Granat, Lawrence A. Oberman, Steven G. Simon and Bradley F. Simon on February 13, 2015. By reason of their role as controlling shareholders and/or sole directors of TII, each of Douglas Granat, Lawrence A. Oberman, Steven G. Simon and Bradley F. Simon may be considered the beneficial owners of shares beneficially owned by TII.

|

Voting Agreements

In conjunction with the purchase and sale agreement, Arkansas River Farms has entered into separate voting agreements with each of the following shareholders:

| |

|

|

Shares subject to |

|

| |

Shareholder |

|

Voting Agreements |

|

| |

Mark W. Harding |

|

727,243 |

|

| |

Harrison H. Augur |

|

108,281 |

|

| |

PAR Capital Management, Inc. |

|

5,982,970 |

|

| |

Total Shares |

|

6,818,494 (28.37%) |

|

With respect to Messrs. Harding and Augur, the shares subject to their voting agreements include the shares owned by related entities described in footnotes 1 and 2 above, respectively. Each voting agreement expires on the earlier of (i) the first calendar day following receipt of shareholder approval of the sale of the Arkansas River Assets and (ii) the date on which the purchase and sale agreement is terminated. Pursuant to the terms of these voting agreements, each of these shareholders has agreed to vote as follows:

|

|

·

|

in favor of approval of the sale of the Arkansas River Assets;

|

|

|

·

|

against any proposal or transaction made in opposition to, or in competition with or inconsistent with the sale, including a superior proposal (unless the purchase and sale agreement has been terminated pursuant to its terms prior to the vote);

|

|

|

·

|

against any other action, agreement or transaction that is intended to or the effect of which would result in materially impeding, interfering with, delaying, postponing, discouraging or adversely affecting the sale of the Arkansas River Assets or any other matters contemplated by the purchase and sale agreement, the voting agreement or the performance by the shareholder of its obligations under the voting agreement;

|

|

|

·

|

against any action, proposal, transaction or agreement that would result in a breach in any respect of any covenant, representation or warranty or any other obligation or agreement of the Company contained in the purchase agreement, or of the shareholder contained in the voting agreement; and

|

|

|

·

|

in favor of any other matter necessary or desirable to the consummation of the sale of the Arkansas River Assets or any other matters contemplated by the purchase and sale agreement.

|

As a result of these voting agreements Arkansas River Farms and these shareholders may be deemed to be a group for purposes of Section 13 of the Securities and Exchange Act of 1934, as amended, with each of the shareholders and Arkansas River Farms being deemed to have beneficial ownership of all of the shares owned by the group. Each of the parties to the voting agreements disclaims beneficial ownership of the shares not directly owned by such shareholder.

PROPOSAL 1

APPROVAL OF THE SALE OF THE ARKANSAS RIVER ASSETS

PURSUANT TO THE PURCHASE AND SALE AGREEMENT

The Company has signed a purchase and sale agreement with Arkansas River Farms providing for the sale of its Arkansas River Assets. The Arkansas River Assets generated $1,068,000 and $1,241,900 or approximately 35% and 67% of Pure Cycle’s total revenues for the fiscal years ended August 31, 2014 and 2013 respectively. The sale represents 49% of Pure Cycle’s market value, based on a closing share price of $4.46 on March 11, 2015. The assets being sold have a book value of approximately $69 million, or 64% of Pure Cycle’s total assets as of November 30, 2014. Because of the significance of the proposed transaction, the board of directors determined to seek shareholder approval of the transaction, and the purchase and sale agreement requires us to hold a special meeting to consider the agreement and the proposed transaction no later than 75 days after the date of the agreement. If we do not obtain shareholder approval, we may terminate the purchase and sale agreement, subject to paying a termination fee of $1,000,000. We currently plan to terminate the purchase and sale agreement unless shareholders representing a majority of the issued and outstanding shares of Pure Cycle common stock approve the sale of the Arkansas River Assets pursuant to the purchase and sale agreement. We are therefore seeking the approval from our shareholders of the sale of Arkansas River Assets.

The immediately following sections of this proxy statement describe the Arkansas River Assets, the material aspects of the sale of the Arkansas River Assets and the purchase and sale agreement. You should read carefully this entire document and the other documents to which we refer, including the purchase and sale agreement attached as Annex A, for a more complete understanding of the proposed transaction.

Information About the Arkansas River Assets

Arkansas River Water

The Arkansas River Assets include senior water rights in the Arkansas River and its tributaries in southeastern Colorado. Our water rights are represented by 18,448.44 shares of the Fort Lyon Canal Company (the “FLCC”), which is a non-profit mutual ditch company established in the late 1880s that operates and maintains the 110-mile Fort Lyon Canal between La Junta, Colorado and Lamar, Colorado. We acquired our Arkansas River Assets from High Plains A&M, LLC (“HP A&M”), pursuant to an Asset Purchase Agreement dated May 10, 2006.

In order to utilize the Arkansas River water in the Front Range (generally the area extending from Fort Collins on the north to Colorado Springs on the south), which is where our service areas are located, we would be required to convert this water to municipal and industrial uses. Change of water use must be done through the Colorado water court and several conditions must be present prior to the water court granting an application for transfer of a water right. A transfer case would be expected to include the following provisions:

|

|

·

|

a provision of anti-speculation in which the applicant must have contractual obligations to provide water service to customers prior to the water court ruling on the transfer of a water right;

|

|

|

·

|

the applicant can only transfer the “consumptive use” portion of its water rights (Pure Cycle expects to face opposition to any consumptive use calculation of the historic agricultural uses of its water);

|

|

|

·

|

applicants would be required to mitigate the loss of tax base in the basin of origin;

|

|

|

·

|

applicants would have re-vegetation requirements to restore irrigated soils to non-irrigated; and

|

|

|

·

|

applicants would be required to meet water quality measures which would be included in the cost of transferring the water rights.

|

Arkansas River Land

The Arkansas River Assets also include approximately 14,641 acres of real property which is being used for agricultural purposes and was acquired from HP A&M in 2006 in connection with the water acquisition described above. Of the acreage we own, approximately 78% is irrigated. In addition, we acquired any mineral rights owned by HP A&M on the land. The extent of such mineral rights, if any, has not been determined. The land is located in the counties of Bent, Otero and Prowers in southern Colorado. We also own certain contract rights, tangible personal property and other water interests related to the Arkansas River water and land.

The land we own is divided into separate properties, each of which is being leased to area farmers. Most of the operating leases expire on December 31, 2015, or allow the Company to terminate the leases annually.

Sale of the Arkansas River Assets

This discussion of the sale of the Arkansas River Assets is qualified in its entirety by reference to the purchase and sale agreement, which is attached to this proxy statement as Annex A. Shareholders are encouraged to read the purchase and sale agreement carefully and in its entirety, as it is the definitive legal document that governs the sale of the Arkansas River Assets.

Background of the Sale of the Arkansas River Assets

Our board of directors continuously reviews our strategic goals and alternatives, performance and prospects as part of its ongoing evaluation of its business in an effort to enhance shareholder value. From time to time, this review has included consideration of a wide range of possible strategic transactions. The summary below provides the background of the proposed sale of the Arkansas River Assets.

The buyer, Arkansas River Farms, is an affiliate of C&A Companies, Inc. (“C&A”), and Resource Land Holdings LLC (“RLH”). C&A is a Colorado-based real estate investment and operations company with interests ranging from residential to multifamily and commercial real estate investments. The firm has invested in agricultural projects in the Arkansas River Valley for 15 years and most recently completed a forage assemblage of over 10,000 irrigated acres in a joint venture with Syracuse Dairy. RLH is a real estate private equity firm based in Denver, Colorado with a focus on natural resource real estate including agricultural, timber and mining properties throughout the U.S. and Canada. Resource Land Holdings has organized private equity funds with in excess of $550 million of committed equity and purchased assets across 25 U.S. states and Canada.

Management of the Company and principals of Arkansas River Farms have been engaged in discussions regarding farm operations in southeast Colorado for a number of years. Management and the principals have met on several occasions to discuss farm improvements, operations, water rights, water transfers, and other business concerns. Subsequent to the settlement of the HP A&M litigation in January of this year, the parties met to discuss opportunities relating to corporate farming, irrigation improvements and other areas of interest. Through the course of these discussions, the parties began exploring interest for a sale of the assets. Concurrent with discussions with C&A and RLH, management also initiated discussions with a number of other large agricultural enterprises to inquire about interest and pricing to determine comparative values for the assets to inform its discussions with the principals of the buyer. After consulting with the board of directors of the Company, comparing the potential opportunities with other interested parties, management entered into contract negotiations with C&A and RLH which ultimately resulted in the proposed transaction.

Uses of the Proceeds from the Sale of the Arkansas River Assets

Approximately $6 million of the proceeds from the sale of the Arkansas River Assets will be used to repay all Company debt. Another $6 million will be used over the following six years to fund our investment in WISE. The remainder of the proceeds will be used for working capital and general corporate purposes. The board of directors will consider additional investments in water, wastewater, infrastructure and its Sky Ranch project. The board of directors continues to look at opportunities to invest assets consistent with the Company’s strategy.

Recommendation of the Pure Cycle Board and Reasons for the Sale of the Arkansas River Assets

After due consideration and consultation with its legal advisors, the board of directors has unanimously:

|

|

·

|

determined that the sale of the Arkansas River Assets and other transactions contemplated by the purchase and sale agreement are in the best interests of Pure Cycle and its shareholders from a financial and procedural point of view;

|

|

|

·

|

approved the purchase and sale agreement; and

|

|

|

·

|

recommended that Pure Cycle’s shareholders vote in favor of the sale of the Arkansas River Assets pursuant to the purchase and sale agreement.

|

In reaching the determinations set forth above, the board of directors considered a variety of business, financial and market factors based upon, among other items, (i) the board’s familiarity with the business and operations of Pure Cycle and the industry in which it operates, (ii) management reports and presentations regarding our properties and assets, financial condition, competitive position, business strategy and prospects, (iii) economic and market conditions as they relate to the water industry, both on a historical and on a prospective basis, and (iv) a careful review of the terms and conditions of the transaction contemplated by the purchase and sale agreement. In particular, the board considered the positive factors set forth below:

|

|

·

|

The change of use of the Arkansas River water to residential use and transport to the Front Range will require significant capital costs and human and other resources that we may not be able to finance or support.

|

|

|

·

|

The book value and market value of the Arkansas River Assets (based on various metrics and methodologies) were considered to determine whether the sale price pursuant to the purchase and sale agreement was attractive to us and our shareholders.

|

|

|

·

|

The net sale proceeds from the proposed transaction will allow us to eliminate our debt, fund our committed obligations to WISE, and leave us sufficient capital to provide us with the flexibility to pursue development at Sky Ranch and other strategic opportunities.

|

|

|

·

|

The financial and other terms and conditions of the purchase and sale agreement, which is the product of extensive deliberations and analysis, including among other things, consideration by the board of directors, the input of independent counsel and negotiations between the Company and Arkansas River Farms, including:

|

|

|

-

|

the fact that we are permitted to furnish information to and conduct negotiations with third parties regarding an alternative acquisition proposal of the Arkansas River Assets in certain circumstances;

|

|

|

-

|

the fact that we are permitted to terminate the purchase and sale agreement in order to accept a competing proposal to acquire the Arkansas River Assets by a third party that is a superior proposal upon the payment to Arkansas River Farms of the termination fee (see The Purchase and Sale Agreement – Non-solicitation below), subject to compliance with the purchase and sale agreement; and

|

|

|

-

|

the board’s belief, after consultation with its legal advisors, that either the $2.5 million or the $1 million termination fee (which represents approximately 4.7% and 1.9%, respectively, of the sale price of the Arkansas River Assets and approximately 2.3% and 0.9%, respectively, of the market capitalization of Pure Cycle) that may become payable (and the circumstances when such amounts are payable) in the event that the purchase and sale agreement is terminated under certain circumstances is reasonable in light of the facts and circumstances surrounding the sale of the Arkansas River Assets, the benefits of the proposed transaction and commercial practice.

|

|

|

·

|

We believe that we may be able utilize a portion of our net operating losses to offset the difference between the Company’s tax basis in the Arkansas River Assets and the sale price of the Arkansas River Assets.

|

The board of directors also considered potentially negative factors concerning the purchase and sale agreement, including the following:

|

|

·

|

The risk that entering into the purchase and sale agreement may result in a loss to shareholder equity based on the difference between the sale price of the Arkansas River Assets and the book value of the assets on the Company’s balance sheet.

|

|

|

·

|

The risk that entering into the purchase and sale agreement could result in a loss of interest by other parties to make a definitive proposal for the acquisition of the Arkansas River Assets, particularly in light of (i) the $1 million termination fee to be paid to Arkansas River Farms if we do not obtain shareholder approval in certain circumstances or (ii) the $2.5 million termination fee to be paid to Arkansas River Farms if the board of directors approves and recommends a superior acquisition proposal for the Arkansas River Assets from another entity in certain other circumstances.

|

|

|

·

|

The restrictions in the purchase and sale agreement on the operation of the Company’s business during the period between the signing of the purchase and sale agreement and the completion of the transactions contemplated by the purchase and sale agreement, which include causing its tenant farmers to maintain the properties in good condition and repair and not entering into any lease with respect to the properties without the prior consent of Arkansas River Farms, thereby potentially limiting the Company’s ability to pursue other business strategies for the Arkansas River Assets during this period, which might have resulted in greater returns than those expected from the purchase and sale agreement.

|

|

|

·

|

The possibility that the financial market’s perception of the proposed transaction could lead to a decrease in the trading price of Pure Cycle common stock, thereby potentially reducing the long-term equity value of the Company if the proposed transaction is not completed.

|

|

|

·

|

The significant cost involved in connection with negotiating and completing the purchase and sale agreement, and the substantial amount of management time and effort required to effect the transactions contemplated by the purchase and sale agreement, particularly since we have a small number of employees and management has many other responsibilities.

|

The board of directors also considered the likelihood of the existence of an alternative buyer willing to acquire the Arkansas River Assets for cash at a valuation superior to that proposed by Arkansas River Farms. The board of directors ultimately concluded, in light of the various factors described above, including the inclusion of customary “fiduciary out” provisions, the reasonable termination fee and the Company’s ability to discuss and negotiate unsolicited offers from third parties, that the sale of the Arkansas River Assets was in the best interest of the shareholders notwithstanding the Company’s inability to actively solicit alternative buyers following execution of the purchase and sale agreement.

The foregoing discussion of the information and factors considered by the board of directors is not exhaustive, but includes material factors considered by the board. In view of the wide variety of factors considered by the board of directors in connection with its evaluation of the purchase and sale agreement and the complexity of such matters, the board of directors did not consider it practical, nor did it attempt, to quantify, rank or otherwise assign relative weights to the specific factors that it considered in reaching a decision. The Company’s board of directors discussed the factors described above, asked questions of management and the Company’s legal advisors and reached consensus that the purchase and sale agreement was in the best interests of Pure Cycle shareholders. In considering the factors described above, individual members of the board of directors may have given different weight to different factors and may have applied different analyses to each of the material factors considered.

No Dissenters’ or Appraisal Rights

Under Colorado law, Pure Cycle shareholders will not be entitled to dissenters’ or appraisal rights in connection with the transactions contemplated by the purchase and sale agreement.

Interests of Pure Cycle Executive Officers and Directors in the Sale of the Arkansas River Assets

The officers and directors have no personal interest in the sale of the Arkansas River Assets other than to the extent they own shares of Pure Cycle. Their interests as shareholders in the proposed transaction are no different than those of the other shareholders.

The Purchase and Sale Agreement

This section of this proxy statement is a summary of the material provisions of the purchase and sale agreement, a copy of which is attached to this proxy statement as Annex A. Because the description is a summary, it does not contain all of the information about the purchase and sale agreement that may be important to you. You should refer to the full text of the purchase and sale agreement, which is hereby incorporated by reference into this proxy statement, for details of the sale of the Arkansas River Assets and the terms and conditions of the purchase and sale agreement.

The Sale of the Arkansas River Assets

The Company and Arkansas River Farms entered into the purchase and sale agreement dated March 11, 2015. The purchase and sale agreement provides that, upon the terms and conditions set forth purchase and sale agreement, the Company will sell approximately 14,641 acres of real property located in Bent, Otero and Prowers Counties, Colorado, together with certain rights, easements, and benefits appurtenant to the land, including all improvements, all sand and gravel, 25% of the Company’s mineral rights, and certain water rights, including 18,448.44 shares of stock in FLCC, 45 shares of stock in Lower Arkansas Water Management Association, all water taps and rights to acquire water taps associated with the land and the wells located on the land to Arkansas River Farms for approximately $53.0 million in cash, subject to such amendments to the purchase and sale agreement as may be approved by the board of directors. The sale represents 49% of Pure Cycle’s market value, based on a closing share price of $4.46 on March 11, 2015. The assets being sold have a book value of approximately $69 million, or 64% of Pure Cycle’s total assets as of November 30, 2014.

Completion and Effectiveness of the Sale of the Arkansas River Assets

The parties will complete the transactions contemplated in the purchase and sale agreement when all of the conditions to completion of the transactions, as contained in the purchase and sale agreement, are satisfied or waived. The parties anticipate closing the transactions 15 days after expiration of the 60-day due diligence period, subject to one 30-day extension, or at such other time as the parties mutually agree.

Due Diligence Period

The due diligence period under the purchase and sale agreement commenced on March 19, 2015, the later of the date on which (i) the Company filed a Current Report on Form 8-K with the SEC disclosing the proposed transaction (filed on March 17, 2015) and (ii) Arkansas River Farms entered into voting agreements with holders of at least 27% of the issued and outstanding shares of Pure Cycle common stock agreeing to vote their shares in favor the sale of the Arkansas River Assets (executed on March 19, 2015). Arkansas River Farms has 60 days from March 19, 2015, to complete a title review and other due diligence of the Arkansas River Assets, unless Arkansas River Farms uses an additional available period of 30 days to complete its due diligence investigation or seeks to obtain new surveys as described below.

Within one business day of execution of the purchase and sale agreement, the Company was required to and did provide Arkansas River Farms with copies of each existing survey covering any portion of the Arkansas River land. If Arkansas River Farms seeks to obtain a new survey for any portion of the properties for which there is no existing survey, Arkansas River Farms shall have (i) up to 90 days after execution of the purchase and sale agreement to obtain any such new surveys and (ii) until the end of such 90-day period to deliver a title objection notice with respect to any land for which a new survey is required, after which the Company shall have five business days to respond any such objection notice.

Based on the due diligence review, if Arkansas River Farms is not satisfied with the Arkansas River Assets, then Arkansas River Farms may terminate the purchase and sale agreement on or before the end of the 60-day due diligence period, at which point the $1 million earnest money deposit shall be returned to Arkansas River Farms. Upon expiration of the 60-day due diligence period, if Arkansas River Farms has not terminated the purchase and sale agreement, the Company will receive the earnest money deposit, which is non-refundable except in limited circumstances.

Purchase Price Adjustment

As part of the sale of the Arkansas River Assets, the Company will convey 18,448.44 shares of stock in FLCC. The parties ascribed excess water value to a certain number of FLCC shares (“Dry-Up Shares”) that have been historically used to irrigate the Arkansas River land. As part of the due diligence process, Arkansas River Farms has the right to review all dry-up covenants related to the Dry-Up Shares. To the extent that the dry-up covenants do not provide adequate enforceable dry up of the property on which the Dry-Up Shares have been historically used in Arkansas River Farm’s reasonable discretion, Arkansas River Farms may elect not to purchase such portion of the Dry-Up Shares. In that case, the sale price will be reduced in an amount equal to $1,625.00 for each Dry-Up Share that Arkansas River Farms elects not to purchase. Arkansas River Farms must provide written notice to the Company of which Dry-Up Shares it elects not to purchase at least 10 business days prior to closing.

Earnest Money Deposit

Within three business days after signing the purchase and sale agreement, Arkansas River Farms made an earnest money deposit of $1 million with an escrow agent. The earnest money deposit is refundable to Arkansas River Farms until completion of the 60-day due diligence period. Upon expiration of the 60-day due diligence period, if Arkansas River Farms has not terminated the purchase and sale agreement, the deposit will no longer be refundable to Arkansas River Farms, unless the Company defaults under the purchase and sale agreement or terminates the agreement.

Representations and Warranties

The purchase and sale agreement contains representations and warranties made by the Company regarding aspects of our business, assets, financial condition and structure, as well as other matters pertinent to the sale of the Arkansas River Assets. These representations and warranties are made as of the date of the purchase and sale agreement and the closing date, are subject to knowledge and other similar qualifications in many respects and will survive for one year after closing.

The representations and warranties made by the Company relate to, among other things:

|

|

·

|

due organization and organizational power;

|

|

|

·

|

authorization of the execution and performance of the purchase and sale agreement;

|

|

|

·

|

absence of required consents from third parties, other than Pure Cycle shareholders, in connection with the execution and delivery of the purchase and sale agreement;

|

|

|

·

|

non-contravention of the purchase and sale agreement with any governing document, contractual commitment or applicable law;

|

|

|

·

|

absence of certain condemnation proceedings or administrative actions relating to the Arkansas River Assets;

|

|

|

·

|

absence of certain litigation with respect to any matter affecting the Arkansas River Assets;

|

|

|

·

|

accuracy and effectiveness of the leases, licenses or other occupancy agreements affecting the Arkansas River Assets and absence of any defaults under such agreements;

|

|

|

·

|

absence of leases other than as disclosed;

|

|

|

·

|

absence of any written noncompliance notice of the Arkansas River Assets with any applicable laws, statutes, ordinances, rules or regulations;

|

|

|

·

|

absence of hazardous materials, substances or waste that have been generated, manufactured, used, disposed of, or stored on or in connection with the Arkansas River Assets, subject to certain exceptions;

|

|

|

·

|

absence of “foreign person” status under the applicable Internal Revenue Service rules and regulations;

|

|

|

·

|

bankruptcy and insolvency; and

|

|

|

·

|

status of the water rights as appurtenant to the Arkansas River Assets and the historical use of such rights.

|

In addition, all parties to the purchase and sale agreement made representations and warranties regarding the absence of broker’s fees in connection with the proposed transaction.

The full text of the representations and warranties can be reviewed in Sections 9 and 12 of the purchase and sale agreement.

Non-solicitation

The Company is not permitted to execute or negotiate agreements with or solicit inquiries for proposals from any party other than Arkansas River Farms with respect to the sale of the Arkansas River Assets. The Company’s non-solicitation obligations are qualified by “fiduciary out” provisions which provide that the Company may take certain otherwise prohibited actions with respect to an unsolicited alternative proposal if the board of directors determines that the failure to take such action would be inconsistent with its fiduciary duties and certain other requirements are satisfied. The Company may provide confidential information to and negotiate with any person who gives the Company an alternative proposal without the Company having violated the “no solicitation” provisions of the purchase and sale agreement. If the board of directors determines that an unsolicited, bona fide proposal to acquire the Arkansas River Assets is more favorable, from a financial perspective, to the shareholders of Pure Cycle (a “superior proposal”), then the Company shall advise Arkansas River Farms of such superior proposal. Arkansas River Farms will have the right to negotiate with the Company for a five business day period following notice from the Company to Arkansas River Farms of such superior proposal prior to the Company’s acceptance of the superior proposal. If the board of directors terminates the purchase and sale agreement pursuant to a superior proposal, the earnest money deposit shall be returned, and the Company shall pay a termination fee of $2.5 million, to Arkansas River Farms.

Covenants

The purchase and sale agreement contains certain other covenants and agreements, including, among others, covenants related to:

|

|

·

|

the operation of the Company’s business during the period between the signing of purchase and sale agreement and closing, which includes causing the tenant farmers of the Arkansas River Assets to maintain the properties in good condition and not entering into any lease with respect to the assets without the prior consent of Arkansas River Farms;

|

|

|

·

|

reasonable access to such documents and information regarding the Arkansas River Assets between the signing of the purchase and sale agreement and closing;

|

|

|

·

|

access to the Arkansas River Assets for surveying purposes, water rights and consumptive use evaluation, soil testing, engineering studies and other inspections, subject to certain restrictions and indemnification provisions;

|

|

|

·

|

the agreement of the parties to cooperate if a party desires to qualify the transaction as a tax-deferred exchange, subject to certain exceptions;

|

|

|

·

|

the receipt of an alternative proposal by the Company pursuant to the purchase and sale agreement (see The Purchase and Sale Agreement – Non-solicitation for more information);

|

|

|

·

|

the agreement of the parties to take all appropriate action and execute all documents, instruments or conveyances that may be reasonably necessary or advisable to carry out the provisions of the purchase and sale agreement after closing; and

|

Conditions to Closing

The Company’s Conditions to Closing

The obligations of the Company to consummate the transactions contemplated by the purchase and sale agreement are subject to the following, on or prior to the closing:

|

|

·

|

Pure Cycle shareholder approval of purchase and sale agreement;

|

|

|

·

|

the delivery by Arkansas River Farms of:

|

|

|

-

|

the balance of the purchase price, as adjusted pursuant to the purchase and sale agreement and credited for the $1 million earnest money deposit; and

|

|

|

-

|

such other documents as may be reasonably be required to complete the transactions contemplated by the purchase and sale agreement.

|

Arkansas River Farm’s Conditions to Closing

The obligations of Arkansas River Farms to consummate the transactions contemplated by the purchase and sale agreement are subject to the following, on or prior to the closing:

|

|

·

|

the satisfaction of the delivery by the Company of:

|

|

|

-

|

special warranty and quitclaim deeds with respect to the Arkansas River Assets and certain water rights;

|

|

|

-

|

a bill of sale conveying certain personal property;

|

|

|

-

|

the original certificates representing certain water rights, subject to certain exceptions;

|

|

|

-

|

possession of the Arkansas River Assets subject to certain leases;

|

|

|

-

|

an assignment of all leases; and

|

|

|

-

|

such other documents as may be reasonably be required to complete the transactions contemplated by the purchase and sale agreement; and

|

|

|

·

|

upon written request from Arkansas River Farms, the termination by the Company of any leases that are terminable by it without penalty as landlord under such leases; and

|

|

|

·

|

all representations and warranties of the Company being true and correct as of the closing.

|

Termination of the Purchase and Sale Agreement

The purchase and sale agreement may be terminated at any time prior to the closing under the following circumstances:

|

|

-

|

Pure Cycle does not obtain shareholder approval of the purchase and sale agreement, in which case the Company will be required to pay Arkansas River Farms a termination fee of $1 million;

|

|

|

-

|

Arkansas River Farms fails to perform any of its material obligations under the purchase and sale agreement and fails to cure within five business days of notice of such default; or

|

|

|

-

|

Pure Cycle’s board of directors receives a superior proposal and determines to accept the proposal; however, Arkansas River Farms will have the right to negotiate with the Company for a five business day period following notice from the Company to Arkansas River Farms of such superior proposal prior to the Company’s acceptance of such superior proposal. If the Pure Cycle board of directors terminates the purchase and sale agreement pursuant to a superior proposal, the earnest money deposit shall be returned, and the Company shall pay a termination fee of $2.5 million, to Arkansas River Farms.

|

|

|

·

|

By Arkansas River Farms if:

|

|

|

-

|

the Company fails to respond to objections by Arkansas River Farms to the commitment for an owner’s extended policy of title insurance and the survey within five business days of such objections;

|

|

|

-

|

it determines, in its sole discretion, it is not satisfied with the Arkansas River Assets during the due diligence period;

|

|

|

-

|

the Company fails fail to perform any of its material obligations under the purchase and sale agreement and fails to cure within five business days of notice of such default;

|

|

|

-

|

any portion of the Arkansas River Assets is condemned, access to the properties is taken or proceedings or negotiations are commenced thereafter prior to closing; or

|

|

|

-

|

any material damage (i.e., in excess of 2% of the purchase price) occurs to the Arkansas River Assets between signing and closing.

|

Default, Remedies and Liability

If Arkansas River Farms fails to (i) perform any of its material obligations under the purchase and sale agreement for any reason other than default by the Company or termination of the purchase and sale agreement and (ii) cure the default within five business days of notice of such default, then the Company may terminate the purchase and sale agreement and receive the $1 million earnest money deposit as liquidated damages, as its sole remedy.

If the Company fails to (i) perform any of its material obligations under the purchase and sale agreement for any reason other than default by Arkansas River Farms or termination of the purchase and sale agreement and (ii) cure the default within five business days of notice of such default, then Arkansas River Farms may (A) enforce specific performance of the purchase and sale agreement against the Company; or (B) terminate the purchase and sale agreement and receive the earnest money deposit as well as reimbursement from the Company for Arkansas River Farm’s third-party out-of-pocket costs and expenses incurred in connection with the purchase and sale agreement, including reasonable attorney’s fees.

Voting Agreements

Pursuant to the purchase and sale agreement, certain shareholders who are directors of Pure Cycle and shareholders over whose shares the directors have voting control (collectively owning 6,818,494 shares, or 28.37% of common stock as of the record date of the special meeting) have entered into separate voting agreements with Arkansas River Farms whereby they have agreed to vote in favor of the sale of the Arkansas River Assets pursuant to the purchase and sale agreement at the special meeting, unless the purchase and sale agreement is terminated in accordance with its terms prior to the special meeting.

Finder’s Fee

Neither Pure Cycle nor any of its affiliates has retained any financial advisor, broker, agent or finder or paid or agreed to pay any financial advisor, broker, agent or finder on account of the purchase and sale agreement or any transaction contemplated by the purchase and sale agreement.

U.S. Federal Income Tax Consequences

There will be no direct tax consequences to the shareholders resulting from the sale by the Company of the Arkansas River Assets, because the sales proceeds will not be distributed to the shareholders. The net income from sale of the Arkansas River Assets will be taxable to the Company. We believe that we may be able utilize a portion of our net operating losses to offset the difference between the Company’s tax basis in the Arkansas River Assets and the sale price of the Arkansas River Assets.

THE BOARD OF DIRECTORS RECOMMENDS THAT THE SHAREHOLDERS VOTE

“FOR” APPROVAL OF THE SALE OF THE ARKANSAS RIVER ASSETS

AS PROVIDED IN THE PURCHASE AND SALE AGREEMENT.

PROPOSAL 2

APPROVAL OF THE ADJOURNMENT OF THE SPECIAL MEETING,

IF NECESSARY OR APPROPRIATE, TO SOLICIT ADDITIONAL PROXIES